Loan Management System

Verifacto Revolutionizes Auto Lending

With Next-Generation LMS & DMS Solutions

The Future of Efficient Loan and Dealer Management Systems

Increase Profitability

Improve payment performance by up to 300%

Reduce insurance risks by up to 500%

Reduce overhead by more than 50%

Reduce Costs

As the industry’s first, no-cost, Loan Management

System. You’ll recognize reduced operational

expenses and increased efficiency

Compliance

Shared data is encrypted and secure with high-security controls. Verifacto makes managing and documenting compliance worry-free

Fast Setup

Our integration team will take the lead and do the heavy lifting. We’ll capture your customer data and migrate that data in hours – not months

Technology Automation

Whether you’re a startup, an established retail or lending company, or a large enterprise, Verifacto’s solutions can be tailored to your company’s unique business processes to help you achieve your goals

One Stop Shop

Verifacto’s single source platform allows you to manage everything from payment processing and insurance tracking to CPI Management, customer’s communication, collection and GPS Tracking

1 out of 6 cars will be in an accident this year.

DON’T LOSE PROFITS ON YOUR INVESTMENT!

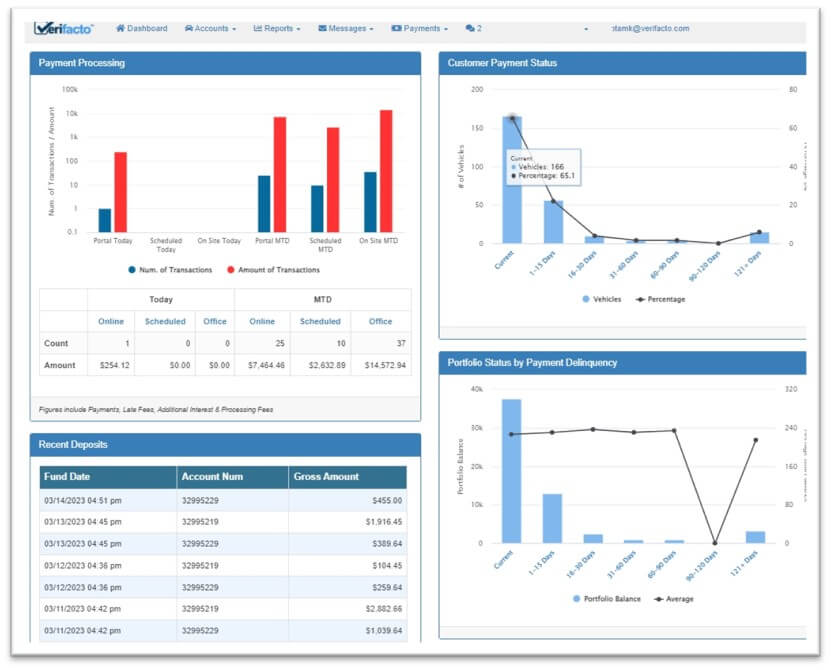

Loan Management System - LMS

Verifacto’s LMS is designed to enable finance companies to maximize profits, increase collections and reduce overhead costs. Equipped with an advanced collection system. Verifacto’s LMS is an all-in-one solution. It is a fully customizable, cloud-based platform that is easy to use and can be up and running in just a few days.

• Quick onboarding process

• Compliance check

• Smart and efficient collections

• AI Based communication system

• Easy QuickBooks integration

• GPS tracking

• LMS is FREE

• Full integration

Dealer Management System

Verifacto's Smart DMS provides dealers with an innovative and fully customizable solution that can help save time, reduce overhead, and increase profitability. Its features include loan origination, compliance tracking, automated collections, advanced payment processing, QuickBooks integration, advanced dashboards and reporting, and an easy lease platform for generating revenue from unsold inventory. With Verifacto's Smart DMS, dealers can manage everything in one place and focus on running their business

- Originations

- Compliance

- Collections

- Payment Processing

- Insurance Tracking

- Collateral Protection Insurance (CPI

- QuickBooks Integration

- Dashboard and Reporting

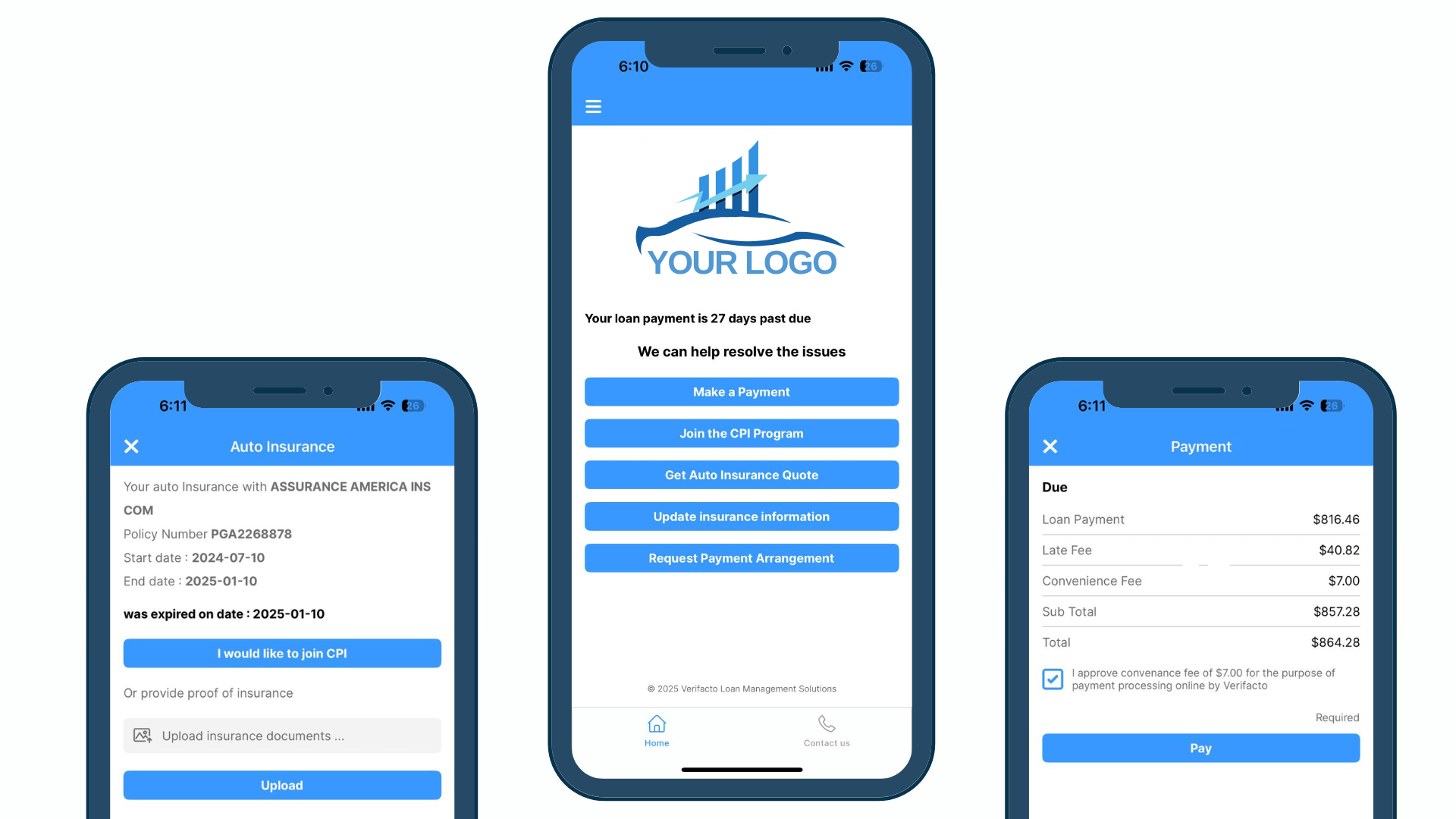

PAYMENT PROCESSING

Verifacto's Payment Processing is revolutionizing the auto industry with its automated payment reminders that increase efficiency by changing message content based on customer behavior. It provides a simple and effective process for customers to make online payments at competitive rates, while allowing auto dealers and finance companies to improve their cash flow

- Advanced Technology

- Comprehensive Solutions

- Cost Effective

- Process Automation

- Payment Reminders

- Easy to Pay with

- Mobile Support

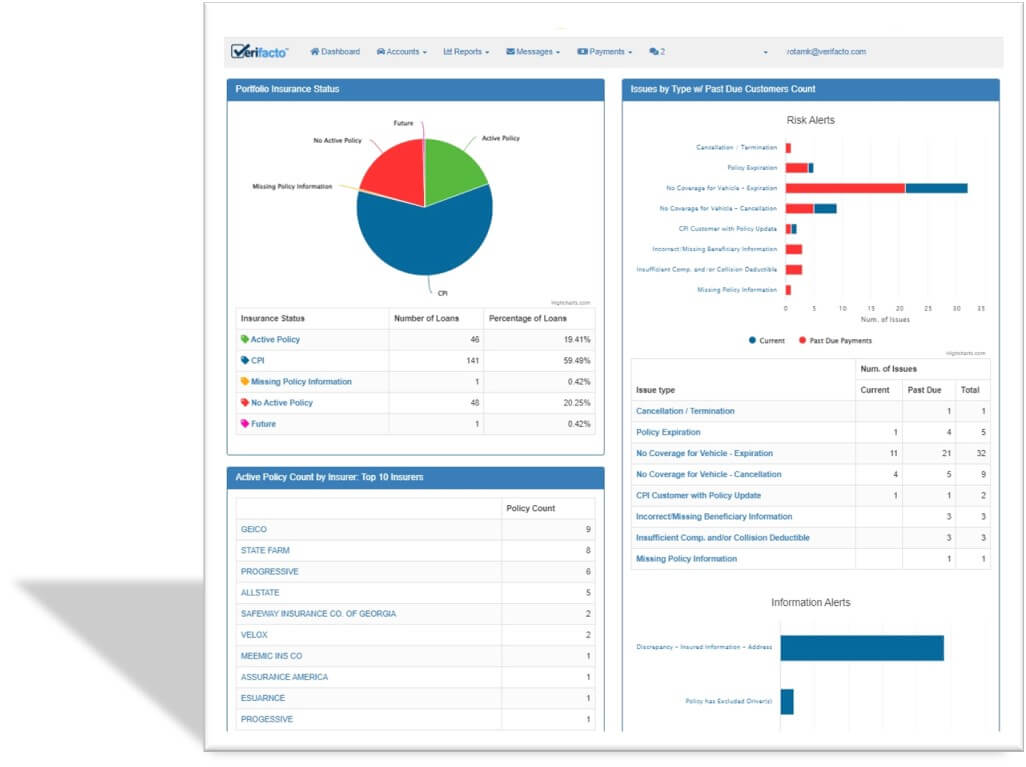

Insurance Tracking - CIMS

Verifacto is a leading provider of cloud-based software enabling auto dealers and lenders to effectively track their customers’ auto insurance status. Our platform provides a comprehensive and effective platform to help dealers and lenders manage, mitigate and reduce insurance risk. We do this by providing cutting-edge technology through a customizable online dashboard which enables users to access data, pull real-time reports with a single click and effectively communicate with drivers to resolve insurance red flags quickly and easily.

- Track insurance coverage on your loans

- Time & Cost Savings

- Document Management

- Increased Control

- Game-Changing Software

- Reliable & Secure

- Great User Experience

- Real Cloud Solution

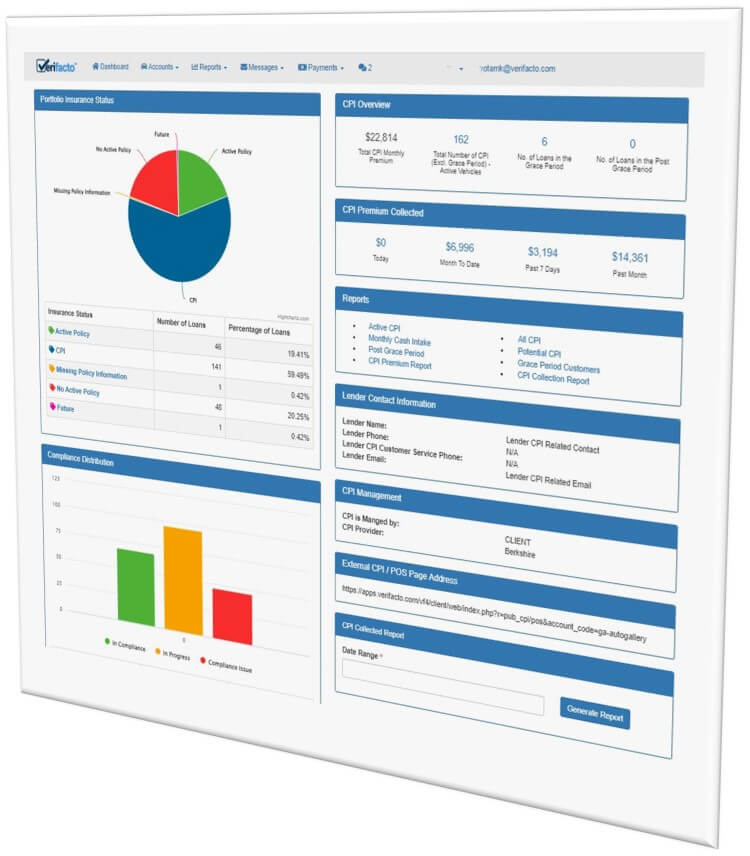

CPI

Verifacto's CPI solution automates the entire program and enforces compliance requirements, providing lenders with visibility and control over their portfolio. The program is designed to manage risk, increase profits, and reduce losses in the loan portfolio. With Verifacto, you can ensure immediate coverage with no waiting period and optimize the profitability of your loan portfolio.

- High-performance

- Immediate coverage with no waiting period

- Profit of the loan is increased

- Fast

- Expert claims Processing Decreases losses in your portfolio

- Advanced technology

- Automation & Efficiency

- Compliance

What Clients Say About Working With Verifacto

PROTECTION

Trusted and Secure

Verifacto is revolutionizing the way lenders manage their portfolios with seamless, secure, and innovative loan management solutions. Empower your business with cutting-edge technology, trusted by leaders in the automotive lending industry, to streamline processes and ensure compliance.